salt tax cap removal

But a downstream impact would be to remove a bit of the. Ace Removal in Monroe Township.

Salt Tax Deduction Democrats Uncertain Over Ending Federal Cap

The deal which was included.

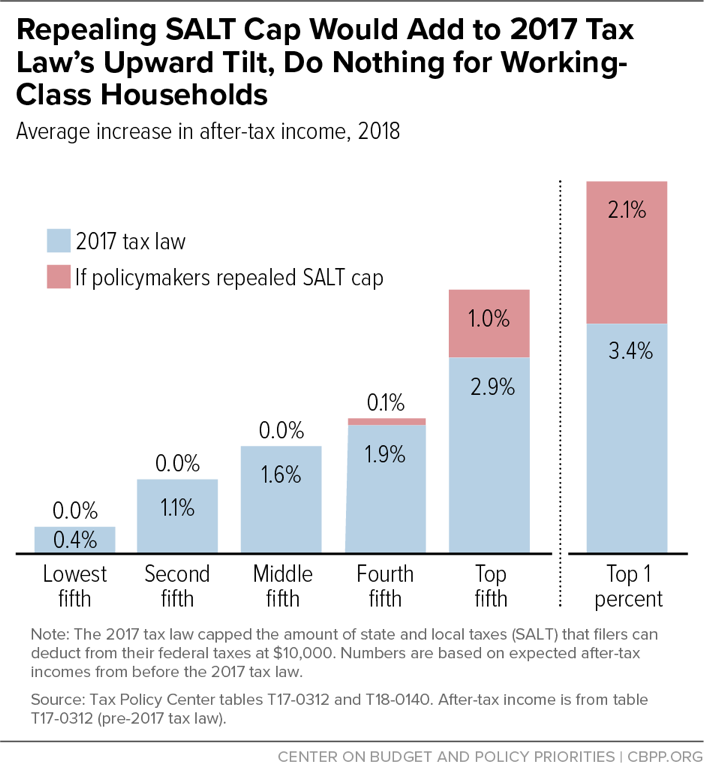

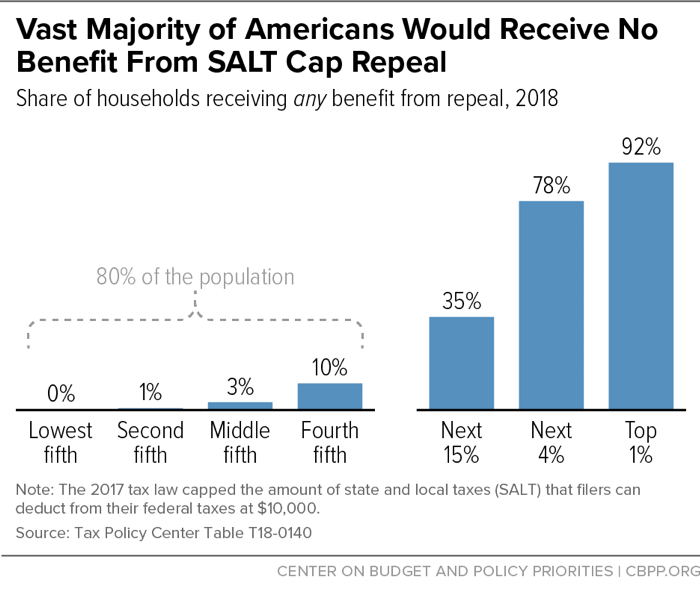

. Restoring the SALT deduction is a necessary first step to creating an equitable tax system one where we put money back in the pockets of working. In the first scenario your 10000 contribution saves you 11200 in taxes a 7500 state credit and a deduction worth 3700 in federal tax savings at the 37 percent top. The so-called SALT deduction was capped at 10000 by former President Donald Trumps tax reform bill which became law in late 2017.

We must go further and undo the cap placed on State and Local Tax SALT deductions by the Trump Administration through the Tax Cuts and Jobs Act in 2017 the. Taxpayers particularly wealthy people. Call Bruno Junk Removal.

But Trump and Republicans placed a 10000 cap on deductions for state and local taxes called SALT in government speak. When youre ready to start your new beginning you know what to do - Call Bruno. The SALT deduction benefits only a shrinking minority of taxpayers.

By Joey Fox October 20 2021 252 pm Responding to reports from yesterday that the State and Local Tax SALT deduction cap lift may be removed from President Joe Bidens. The latest SALT plan would remove the current 10000 cap part of the 2017 tax overhaul entirely for those making less than 400000 a year. Democrats have forged a compromise to partially lift the so-called SALT tax deduction cap that hit the New York metro area particularly hard.

The California Franchise Tax Board reported that in the 2018 tax year the SALT cap cost Californians 12 billion. Prior to that the average SALT deduction in. We look forward to serving you.

California business owners have been given a workaround to the 10000 State and Local Tax SALT itemized. California Approves Workaround to SALT Deduction Cap. Combining SALT cap repeal with reinstatement of the Pease limitation and the prior-law AMT substantially reduces those benefits for high earners resulting in a 08 percent.

In urging repeal of the 10000 cap on the deduction for state and local taxes SALT Rep. That must change.

Buttigieg Courts High Tax States With Salt Cap Removal Plan Fox Business

Suozzi Pushes For Salt Cap Repeal In Infrastructure Plan

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Salt Deduction That Benefits The Rich Divides Democrats The New York Times

Changes To The State And Local Tax Salt Deduction Explained

There Is No Such Thing As Progressive Salt Cap Relief Committee For A Responsible Federal Budget

Lawmakers Launch Bipartisan Salt Caucus Escalating Push To Remove Cap On Federal Deductions For U S State And Local Taxes Marketwatch

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

House Democrats Concede Line In Sand Over Ending Salt Cap Politico

New York Business Leaders Push Biden Schumer To Remove Cap On Salt Deductions

Bill To Remove Cap On Salt Deduction Passes In House Zeldin Votes No 27 East

How Dems Can Get Out Of The Salt Mess And Save 1 Trillion

Democrats Consider Salt Relief For State And Local Tax Deductions

Salt Deduction Cap Repeal Gottheimer And Suozzi Discuss Tax Cuts

Tax Fight Democrats Want Salt Cap Gone In Biden S Big Spending Plans

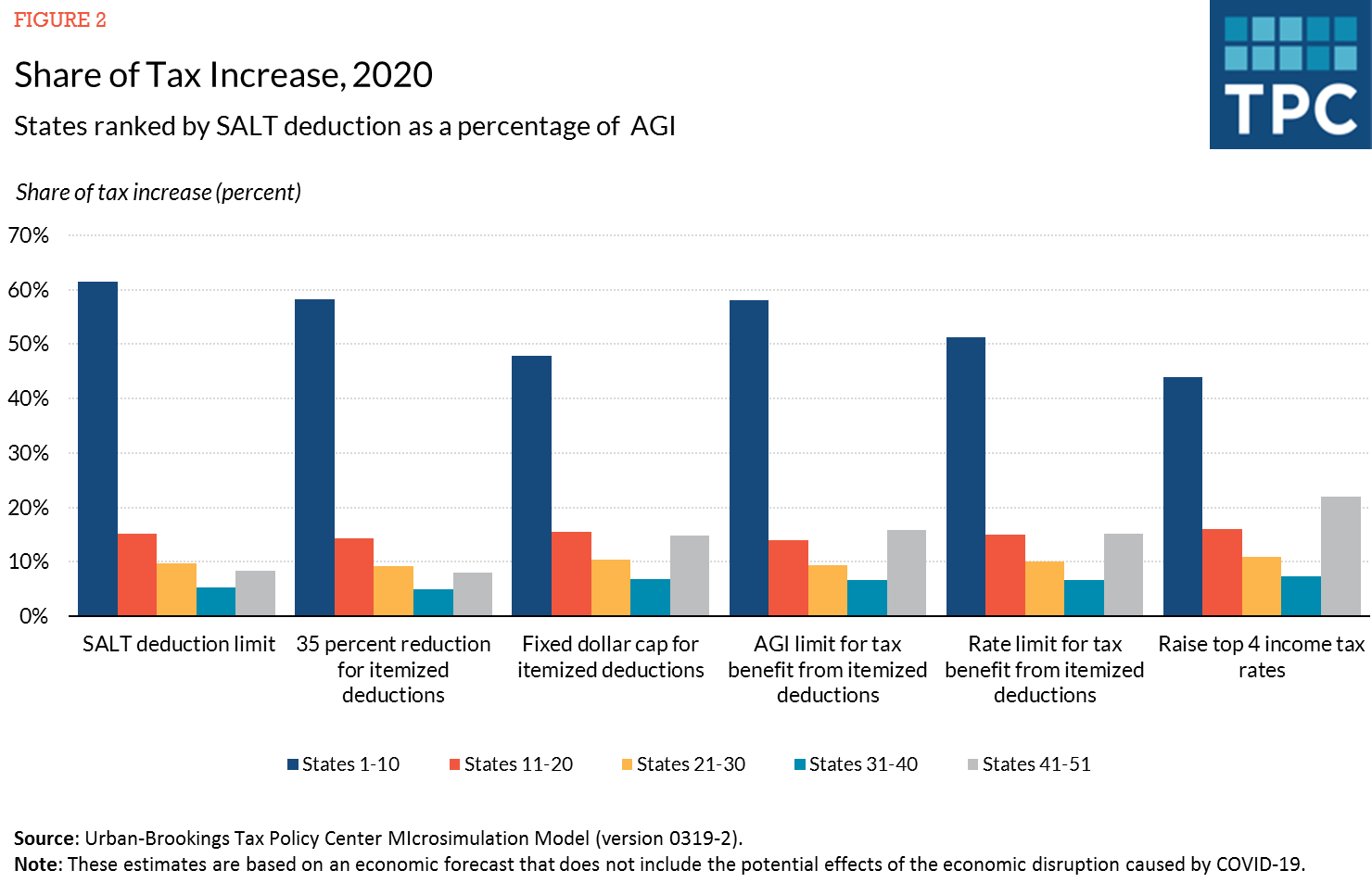

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center

Eliminating The Salt Deduction Cap Would Reduce Federal Revenue And Make The Tax Code Less Progressive

Repealing Salt Cap Would Be Regressive And Proposed Offset Would Use Up Needed Progressive Revenues Center On Budget And Policy Priorities

Salt Cap Democrats Still Batting Around Ideas For How To Reinstate The Contentious Tax Rule